Looking for a mortgage in the Netherlands? Check your possibilities.

A mortgage calculation depends on several factors and can vary by provider in The Netherlands. We compare mortgages from multiple providers. Request a free mortgage calculation by phone from an (external) mortgage specialist. Your privacy is our priority.

Done in 2 minutes

Closing a mortgage, this is how it works

A mortgage is a type of loan secured by the property you buy. Because the house serves as collateral, the lender has extra security. Mortgages are mainly used to finance the purchase of a home. If you are unable to repay the mortgage, the bank can claim ownership of the property. In other words, the bank remains the legal owner until the mortgage is fully repaid.

Because mortgages usually involve large amounts of money, they often run for a long term, typically 20 or 30 years.

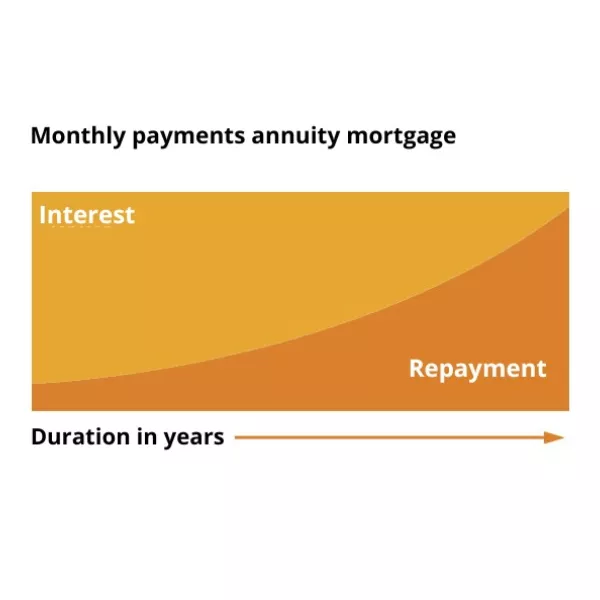

When you take out a mortgage, you usually make a monthly payment to the bank that consists of two parts:

- repayment: reducing your outstanding debt

- interest: the bank’s compensation for lending you the money

For example, if you borrow €250,000 and repay €1,000 in a month, your outstanding balance becomes €249,000.

Get my free calculation now

What are my mortgage options?

There are many mortgage providers, each with different terms and conditions. With us, you’ll quickly receive a phone calculation of your mortgage options. After that, we can connect you with an independent mortgage advisor who will compare offers from multiple lenders for you. This is completely free and with no obligation.

You are, of course, free to choose whether you want us to connect you with a local mortgage advisor or prefer to find one on your own.